So here’s the thing…

This case study is long.

I don’t even know if I should call it a case study, to be honest. It’s more of a deep dive into how our buyer and market research projects unfold.

TL;DR

The Company

Founded in 2015, Rewind sells backup & restoration software for SaaS platforms. The company’s first product was an integration for Shopify. By 2021, the company had grown to over 100,000 customers across 100 countries, protecting multiple SaaS tools. They had recently raised a Series B for $65 million USD.

The company generates revenue from inbound traffic, partnerships and outbound activities. There was a mix of positions in sales and marketing at the time. I was hired by the CMO to work with Ahmet Ozcelik, Product Marketing Manager for Rewind at the time. He oversaw the go-to-market strategies for products that target developers and developer operations. He had worked as a senior marketer for over a decade.

What Triggered Market Research

After their first round of VC funding, Rewind acquired another company called BackHub. BackHub had developed software that backed up and restored data for GitHub code repositories. GitHub is one of the largest code repositories in the world, used by tens of millions of developers.

After the acquisition, the founding team that developed this GitHub integration had strong opinions about who the ideal and best-fit buyer should be. After all, they had paying customers who fit this segment. So Rewind invested over seven figures into a go-to-market strategy to capitalize on this new merger.

This led the executive team at Rewind to forecast a big increase in sales. …It didn’t happen.

Rewind’s sales teams were not able to close deals with these buyers.

Outbound campaigns were landing with a thud.

The team had suspicions that their go-to-market strategy was off.

“We felt we didn’t have a good handle on who the ideal buyer was. As a team, we had some ideas and opinions, but needed more data and evidence from the market”

Ahmet Ozcelik, Product Marketing Manager, Rewind

Why Go-To-Market Programs Fail

There’s more than five decades of solid data from both the academic world and the industry that tell us go-to-market programs fail for two main reasons.

A third of the time, go-to-market investments fall down due to poor execution.

However, two-thirds of the time, go-to-market programs fail due to a lack of buyer and market understanding. A core reason for this gap: B2B teams use the wrong data to try and understand the market.

They default to CRM data, Web Search, AI and listening to sales calls. However, those data sources are not reliable for in-depth market research.

❌ Sales calls are unreliable sources of data for solid research. They are highly prone to sample bias, confirmation bias and moderator bias.

❌ CRMs & dashboards are static snapshots. They tell you what happened; they will not tell you why things happened.

❌ Buyers spend 83% of a journey NOT interacting with a seller (Gartner) and evaluating their market options based on the recommendations of peers and colleagues

“Before Rewind, I worked with a larger telecom company and also a smaller startup. I had not conducted many interviews before. I had always attended or listened to sales calls.”

- Ahmet Ozcelik, Rewind

Sales calls and all the other data sources we listed out aren’t designed to capture the data and evidence you need to map out strategic go-to-market concepts, like Market Entry, Market Readiness and Product-Market Fit.

Put another way, Rewind was missing key insights about what’s happening before a purchase. They had little evidence about the market realities they were trying to sell into.

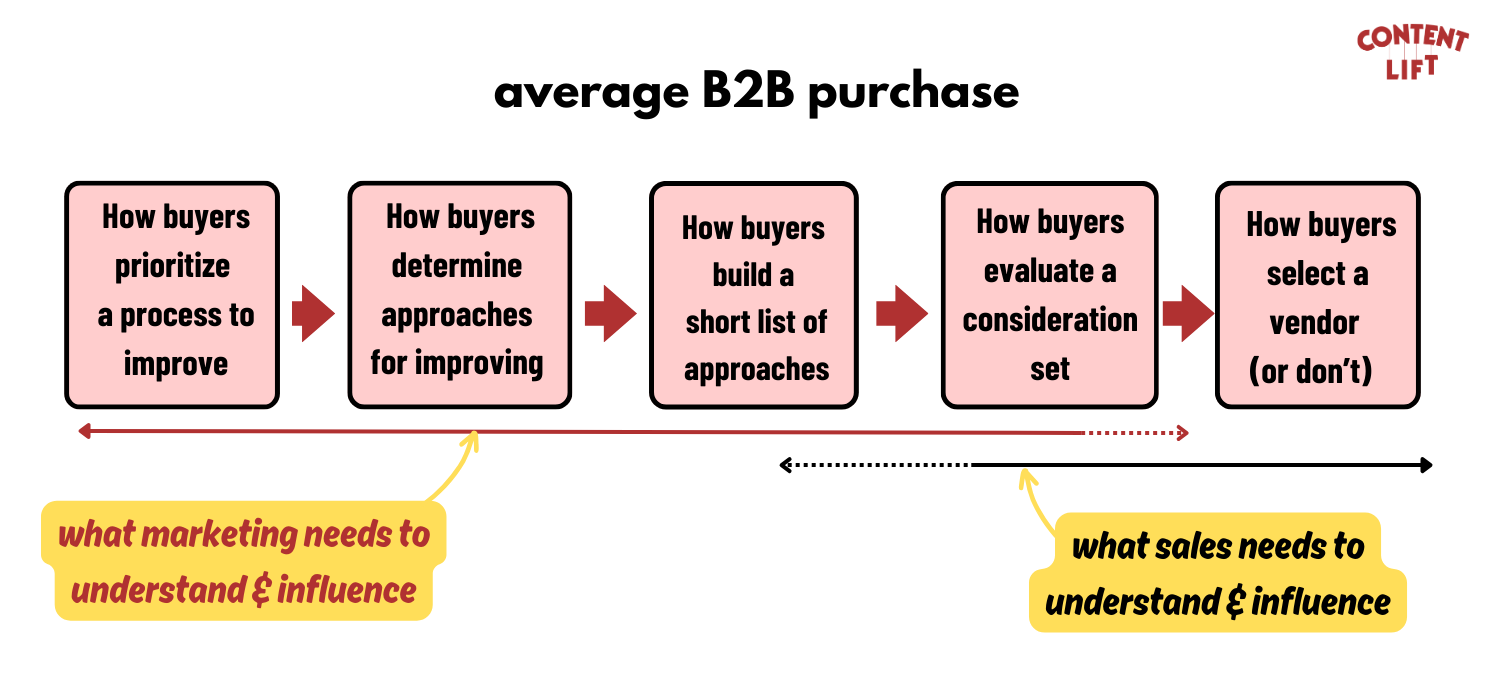

A go-to-market program has to influence the market before a buyer starts looking for a solution. And most importantly, these purchasing decisions happen in the minds of buyers. So you need data and evidence collection methods (1:1 interviews!) that extract these insights. Most teams focus on the tail end of the buying journey because that is the data they are using to make decisions.

“Listening to sales, to be honest, is less effective because the point of that conversation is to sell something. Speaking with a buyer, with the structure Ryan built, brings significantly more value.”

Ahmet Ozcelik, Rewind

The Go-To-Market Evidence You Need

Working with Rewind, we defined the ideal buyer we wanted to learn more about. For building an evidence-based go-to-market strategy, these are the research objectives and things we aim to understand:

There will be some research objectives specific to each engagement we run, but those are decided with clients. After setting research objectives, we create a list of discussion topics (what research nerds call a Moderation Guide), aligned with each of the go-to-market research objectives.

A common mistake people make when drafting moderation guides is to write out dozens of specific questions. A pre-determined list can be a crutch as it stifles the discovery of new insights. Experienced qualitative researchers know that topic guardrails, with open-ended questions, are best for guiding research interviews.

“Before our first conversation, I was leaning more towards listing the questions out and following a specific order. Your guidance was that it should be a conversation. There should be objectives but also room for flexibility.“

- Ahmet Ozcelik, Rewind

Keywords & vocabulary

Their workflows & processes

Buying triggers and catalysts of change

Their POV on available solutions in the market

Competitive landscape

Which solutions make up their consideration set

How they evaluated their consideration set

Objections, blockers & what they didn’t tell the sales team

Which vendor won & why

Booking & Conducting Interviews

Where B2B teams often go wrong is that they talk to any customer with a pulse. This is a big, BIG mistake. In qualitative market research, we need a homogeneous sample, which is a group of buyers and/or businesses who share the same or very similar characteristics, traits, or experiences relevant to the study's focus.

We work together to figure out the firmographics, psychographics and technographics of your ideal buyer, and use those to determine which individuals we should reach out to.

This screenshot is not from Rewind’s project, but it is an example of what we might create before we recruit buyers for interviews.

Without a vigilant focus on who to speak with (and who not to speak with), we risk getting data that pushes your go-to-market in the wrong direction.

In the next step, we recruit customers or recruit in-market buyers to a 60-minute video call, recorded with their permission. During each investigative interview, we are trying to achieve these things:

Create an environment where participants feel comfortable sharing

Capture behaviors, motivations and lived experiences. Not opinions.

Gather objective buyer evidence and market truths

I want to understand the actions buyers took from identifying a problem, right to the actual purchase. When having one-on-one interviews with buyers, it takes time and a specialized skill set to navigate this. Qualitative research isn’t just “talking”; it’s a process of extraction while navigating and reducing bias (on both sides).

“You were experienced in directing conversations, digging deeper into people’s answers. Most people’s answers are quick. I noticed you went back to refine and focus on what's important. You wanted the reasons behind an answer, rather than moving on to the next question.”

Ahmet Ozcelik, PMM, Rewind

Turning Transcripts into Go-To-Market Evidence

Research nerds call it “Thematic Analysis.” In business speak, it’s turning answers into GTM actions. We review all the recordings and transcripts before synthesizing the data.

Here’s a transcript of Ahmet & I chatting about this case study (it’s super meta)

In the process of thematic analysis, we are aiming for what’s called “Thematic Saturation”. It’s the point at which no new meaningful themes, patterns, or insights emerge from the data (which in this case are the transcripts and conversations).

The final deliverable (like all our engagements) had in-depth details covering key findings, themes and what the risks/opportunities are for Rewind’s go-to-market. The voice of the buyer is prevalent throughout.

It ain’t fancy but it gets the job done (Blacked out to hide proprietary insights)

“I actually thought the level of detail was too much at first. Then I noticed I would go back and re-read everything. It honestly surprised me,” says Ahmet.

“I wanted to refer back to the quotes, remember what customers said in their own words and the examples they gave in detail. I don’t think any of that would’ve been possible without the detail you provided.”

Along with key actions and evidence, we provided Rewind with:

Buying triggers

Positioning and messaging ideas

Copy starters

Talk tracks for the sales team

Topic clusters for content marketing (aligned to buying journey)

The key discovery was that Rewind was targeting the wrong buyer persona. Rewind had been trying to sell to software developers. Their ideal buyer was people leading IT Departments, and now we had a blueprint to build a go-to-market program that could effectively sell to them.

A Marketing Overhaul

From all the evidence and data, the Rewind team levelled up these go-to-market assets:

New sales enablement materials for Account Executives & Partner Managers

New ad copy for paid search & display

Revised product & landing pages

Updated the listing in GitHub Marketplace

New thought leadership topics for events & webinars

Most importantly, all the opinions and guesses were put to bed, and the entire go-to-market team was on the same page.

“We had deeper insights into the buyers purchasing our GitHub product. We also identified who we were NOT selling to. This was vital for speaking internally to other teams, so we weren’t facing a scenario where it’s ‘your idea, versus my idea’. The research gives us everything we needed to create alignment.”

- Ahmet Ozcelik, Rewind

The End Result

✔️ Alignment on ideal client profile (ICP)

✔️ Overhauled buyer personas, positioning & messaging

✔️ Identified and addressed content gaps in the buying journey

✔️ Shifted GTM investments to focus on the new ideal buyer

✔️ 2x the number of product installs

Ahmet Ozcelik, PMM, Rewind

“We almost doubled the number of installs. It was consistent over a two-month period. So, not just a one-time hike. The interviews were direct and gathered quickly, which gave us an advantage over the competion”

Mike Potter, CEO, Rewind